October 27, 2025

Analysts say White House mercy may bolster civil claims against the world’s largest exchange.

By Joe Pan

“I was told what he did was not even a crime,” President Donald Trump quipped to a White House reporter, moments after pardoning Binance founder Changpeng “CZ” Zhao. Within hours, Binance’s BNB token surged nearly 8 percent, but the market euphoria belied a wave of legal aftershocks that analysts say could cost far more than the $50 billion boost the pardon bestowed.

“Trump’s pardon doesn’t free CZ from guilt, it freezes his conviction,” said Joshua Chu, co-chair of the Hong Kong Web3 Association and a senior consultant with Prosynergy Consulting, during an interview with Blockwind News. “A pardon forgives—it doesn’t erase.” Chu argues that Zhao may have merely traded a problem of prison for the prospect of boundless civil litigation.

Legal Mercy, Locked Guilt

CZ’s original conviction under the U.S. Bank Secrecy Act stemmed from failing to implement effective anti-money-laundering protocols—not embezzlement or fraud. It was “supervisory liability—failing to prevent others from misusing Binance’s platform,” Chu said. Zhao’s sentence: a corporate $4.3 billion fine and four months served quietly before Trump’s Oct. 23 pardon.

But what does a pardon really mean? Only courts can erase a conviction, Chu emphasized. By accepting the pardon, Zhao forfeited his appeal, cementing the Department of Justice’s case against him. “Every plaintiff’s lawyer in America just got a new Exhibit A,” he quipped.

If accepting the pardon tightened legal risks, why did Zhao’s team take it? Chu suggests it was a calculated retreat to avoid the risks and exposure of U.S. legal discovery, which could have compelled Binance to turn over troves of internal communications and audits. But he questioned whether Zhao’s lawyers grasped the global consequences. “The U.S. pardon has no extraterritorial force. Hong Kong, Singapore, or Dubai regulators could still use the same record as evidence,” Chu said.

The October 7 Attack and Civil Exposure

A separate wave of litigation stems from civil lawsuits filed after the October 7 attack. Plaintiffs allege crypto routed through Binance financed arms purchases. Because Binance’s KYC and KYB systems were lacking, sanctioned parties transacted freely, Chu explained. U.S. Commodity Futures Trading Commission (CFTC) documents even suggest Binance “encouraged users to circumvent” controls.

Chu said civil proof just got easier: “CZ’s conviction is final and admitted. Every fact used to convict him is frozen. Trump’s pardon confirmed the record.” Now, lawyers can simply quote those findings; they no longer have to re-prove them

The Global Ripple

While Trump’s clemency may have secured headlines and market surges, global regulators—including in the EU, UAE and Hong Kong, all Financial Action Task Force members—could cite the U.S. findings as persuasive precedent. “Trump is the master of his jurisdiction,” Chu said. “But his pardon ends at America’s border. Elsewhere, civil and regulatory actions face no obstacle.” Law firms in Tel Aviv, London and Singapore are reportedly exploring cases mirroring the U.S. model.

Chu warned: “If one [civil suit] wins, others will follow. Binance’s exposure becomes borderless..

Missed Judicial Path

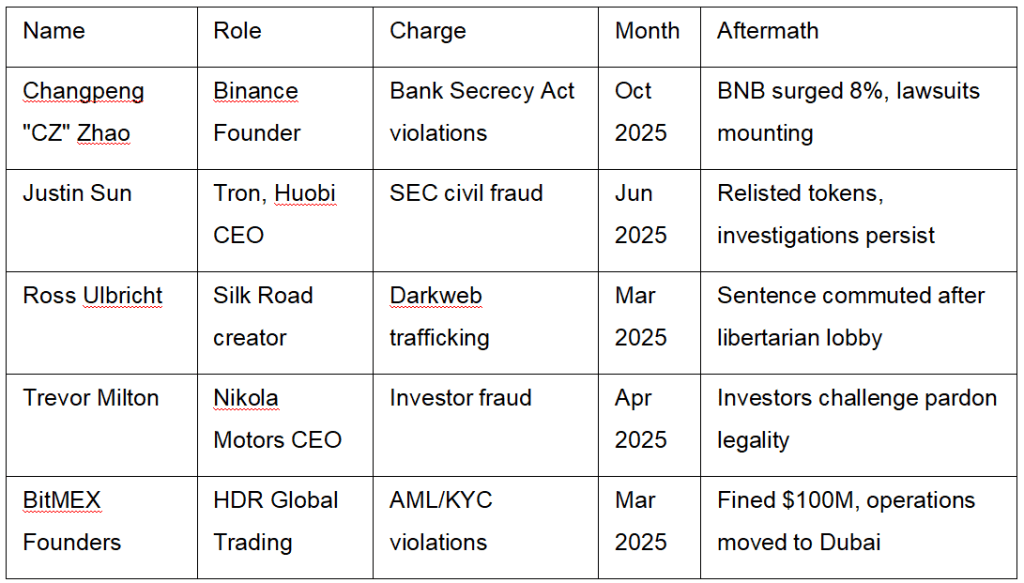

Chu, asked about what Trump could have done differently, described the pardon as a “missed opportunity.” With control of Congress and the Supreme Court, Trump could have endorsed a motion to vacate the conviction—a judicial act that erases, not merely suspends, a crime. “That could’ve given CZ real exoneration,” Chu said. Instead, he got political absolution. Chu contrasted the move with past financial clemencies, such as those for Trevor Milton, Mark Bridge, and Ross Ulbricht, which were domestic in impact. “You can’t pardon money flows that cross 200 jurisdictions,” he said.

White House spokespeople insist the pardon is part of Trump’s campaign to “end the war on crypto.” Critics like Sen. Elizabeth Warren call it a payoff to donors disguised in digital garb. Chu, for his part, played it safe: “Whatever the motive, the effect is the same—Trump transformed CZ’s criminal risk into civil certainty.

Trump’s 2025 Clemencies Tied to Finance and Crypto

Personal Liability Ahead

Before conviction, CZ’s “corporate veil” shielded his assets. Now, with a personal plea and explicit responsibility accepted, that protection is eroded. “Opening his wallet to restitution claims is not hypothetical—anymore,” Chu said. Plaintiffs may now pursue Zhao’s personal wealth as a codefendant, and travel brings ongoing risks of global subpoenas.

Winston Ma, adjunct professor at NYU School of Law and investment partner at a U.S.-based family office, sees critical limitations to the pardon:

“The U.S. president’s pardon is related to CZ’s individual case,” said Ma. “Foreign judgments, such as those from Singapore or EU civil awards, could potentially be enforced against CZ’s U.S. assets. Such enforcement might face conflicts of law challenges in a cross-border context, but not likely as a result of the pardon.

What Happens Next?

Analysts predict that 2026 could bring a historic surge in crypto tort cases. Whether CZ emerges as a named party in global litigation will depend on plaintiffs’ creativity—and the degree of cooperation Binance displays with regulators. But one paradox endures, Chu concluded: “Only the guilty can be pardoned. By receiving mercy, CZ confirmed the very guilt his investors keep denying. The markets may have forgiven. Civil law likely won’t.

Joe Pan is an editor and producer at Blockwind News. An early adopter of blockchain technology, he has covered major crypto conferences globally since 2019 and moderated Web3 events across Asia. Joe is part of the founding team of Blockwind News and teaches Asia’s first Master of Journalism course on “Covering Cryptocurrency and Blockchain” at Hong Kong Baptist University.