September 02, 2025

By Joe Pan

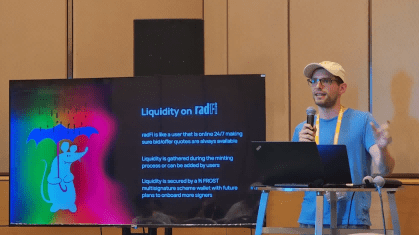

RadFi’s launch in July 2025 is making waves among traders of Bitcoin-native assets, like rare sats, inscriptions, or runes. Co-founder Scott Smiley (@benny_options) shared what’s driving the initial success of the Bitcoin Layer 1 DeFi platform, especially among Chinese traders at the BitcoinAsia Conference in Hong Kong.

The “Planned Luck” Effect

“It was somewhat of a surprise to me that there was so much interest from the Chinese community,” Smiley confessed, having watched the RadFi social accounts “flooded with messages in Chinese” following its debut crash from overwhelming demand. He described the surprising popularity of RadFi within the Chinese community as a case of “planned luck”, saying, “You place yourself at the right place and let luck or good things happen,” echoing planned happenstance theory developed by John D. Krumboltz, which he learned during his Vanderbilt University days.

For those who missed the drama, RadFi’s website went offline on launch day, besieged by eager traders searching for instant swaps and reliable liquidity — a rare treat on the notoriously clunky Bitcoin Layer 1.

The new reality for Bitcoin token launches, Smiley explained, is a far cry from “users burning BTC, receive tokens with zero liquidity.” Instead, “launch capital goes to liquidity pools, instant refunds for failed mints…5+ BTC saved, 25+ tokens launched with actual tradability.” In short: Everyone finally gets to play, trade, and cash out — no more gambling away coins with nothing to show but hefty miner fees and a sad emoji.

But the real secret sauce? RadFi’s technical breakthrough: “First instant swaps on Bitcoin L1 without custody trade-offs. No 10-minute block waiting, no additional trust assumptions,” Smiley said, channeling the pragmatic optimism of a Deutsche Bank alumnus who’s grown up fast in decentralized finance.

What impressed Emma about RadFi was the user experience. “Using a 2-of-2 multisig wallet, transactions are confirmed with zero waiting at the mempool stage. The speed is comparable to Solana,” said Emma (@emmaxx1699), a Chinese trader who has used the platform and praised how Scott, as a team leader, has handled platform issues openly and promptly.

The platform’s growth and organic Chinese adoption is spotlighting the pain points of Bitcoin’s on-chain activity. When Scott attended the Bitcoin Asia Conference in Hong Kong, he saw “massive amounts of interest” and “met some enthusiastic users in person” — a sign that the problem of illiquid launches and trade latency is one global traders are itching to solve.

A scan of RadFi’s discord community, one can see Chinese traders exchange messages on their RADs and Doogie, some of the popular Bitcoin-native tokens.

Another feature that reassures Emma is that “it’s fully decentralized: transactions are recorded on-chain, private keys are held by users, and the platform cannot access user funds,” Emma added when reached through Telegram. “Of course, their incentive economic model also helps—one-third of fees are rewarded to long-term holders and token creators, promoting community growth.”

The evidence speaks for itself: Since July, RadFi has facilitated over 25 token launches with liquidity, saved users more than 5 BTC in failed transaction fees and crossed the $5M trading volume mark on multiple days, even as broader markets sagged. The community is abuzz and demand, quite frankly, crashed the app — more than once.

Scott Smiley’s Journey – TRadFi to DeFi

Scott Smiley’s career path is emblematic of the twists and turns common among today’s founders and operators in the crypto space, rather than following any linear trajectory. His journey began in traditional finance at Deutsche Bank, where in 2017 he watched cryptocurrency begin to go mainstream: “Back in 2017, when I was a Deutsche Banker, there were only three coins listed on Coinbase — Ethereum, Bitcoin, and Litecoin. It was the early days when Ethereum shot up from $7 to $70,” he recalled, describing his own slide “into the rabbit hole of cryptocurrency” that would ultimately reshape his career.

Drawn deeper into the industry, Scott was invited by a former banking colleague to join the growing ETH ecosystem in Korea. There, he helped engineer the launch of one of the nation’s largest crypto communities and built key DeFi infrastructure, including a Uniswap-equivalent and a MakerDAO-inspired project. “We built a Uniswap equivalent product. We built a MakerDao equivalent product. So I have a lot of experience building defi protocols,” he said, crediting his technical skillset to both relentless problem-solving and collaboration with talented community engineers.

Scott’s journey would later lead him to explore real-world assets (RWA), before he made a pivotal shift. Encouraged by a team member who had launched the Bitcoin Puppet project, Scott shifted attention to Bitcoin DeFi at a time when enthusiasm in the space was waning, particularly after the highly anticipated—but ultimately disappointing—launch of Runes. Rather than joining those leaving for greener pastures, Scott and his team chose to stay, motivated to solve the pressing issues of liquidity and usability on Bitcoin’s base layer.

RadFi’s core mechanism drew inspiration from the “Light Pools” concept first put forward by Casey Rodarmor. As Scott explains, “The idea behind Light Pools is simple. Users who wish to offer swaps between Bitcoin-native assets, like rare sats, inscriptions, or runes, run nodes that quote prices for swaps.” While Rodarmor critiqued automated market makers (AMMs) for lacking technical efficiency, Scott’s team blended Light Pools’ peer-to-peer swap vision with AMM-style pricing and automation—giving less technical users a way to participate and ultimately deepening liquidity for all Bitcoin tokens.

Arriving for his first Hong Kong trip at the Bitcoin Asia Conference, Scott found the city’s pulsing energy reminiscent of New York, the place he calls home. “For my first Hong Kong trip, I find the City incredible with a vibe similar to New York,” he said, energized by the buzzing community, face-to-face meetings with international users, and the infectious optimism now returning to Bitcoin DeFi thanks to innovations like RadFi.

Since launch, Scott points to several proof points that underscore RadFi’s market traction: more than 5 Bitcoin saved for users, on-chain verifiable; over $1 million in organic TVL secured; and $5 million daily trading volume reached on several occasions, even with prevailing bearish conditions in the broader market.

“DYOR, or do your own research! At the end of the day, trading memecoins is like betting or gambling—you could lose almost everything, if not everything,” Scott said when asked about platform risks beyond scalability challenges.

About the author

Joe Pan is an editor and producer at Blockwind News. An early adopter of blockchain technology, he has covered major crypto conferences globally since 2019 and moderated Web3 events across Asia. Joe is part of the founding team of Blockwind News and teaches Asia’s only accredited Master of Journalism course on “Covering Cryptocurrency and Blockchain” at Hong Kong Baptist University.

Geoffrey Keane Cheng contributed to this article and took the photos. He is a Hong Kong-based Web3 content and social media specialist.